General Motors (GM)·Q4 2025 Earnings Summary

GM Beats EPS, Guides 2026 +15% Above Street, Raises Dividend 20%

January 27, 2026 · by Fintool AI Agent

General Motors delivered a mixed quarter operationally but sent a clear message to shareholders: the capital return machine is accelerating. Adjusted EPS of $2.51 beat consensus by 8.2%, while 2026 guidance of $11-13 came in 15% above the Street. The stock surged 8.4% to $86.10 as investors focused on the forward outlook and the path back to 8-10% North America margins rather than the $7.6 billion in EV restructuring charges.

CEO Mary Barra highlighted that 2025 marked GM's highest full-year U.S. market share in a decade—the fourth consecutive year of share gains—achieved with low inventory, low incentives, and strong pricing. Product accolades reinforced the portfolio strength: the Cadillac Escalade IQ won MotorTrend's SUV and Technology of the Year awards, while the Chevrolet Trax earned Car and Driver's 10 Best list for the third consecutive year.

Did GM Beat Earnings?

Bottom line: Yes on EPS, essentially flat on revenue. Eight consecutive quarters of EPS beats.

The GAAP picture looks dramatically different: a net loss driven by more than $7.6 billion in special charges across Q3 and Q4. These charges stem from GM's "realignment of electric vehicle capacity and investments to adjust to expected declines in consumer demand for EVs, and in response to U.S. Government policy changes including the termination of consumer incentives."

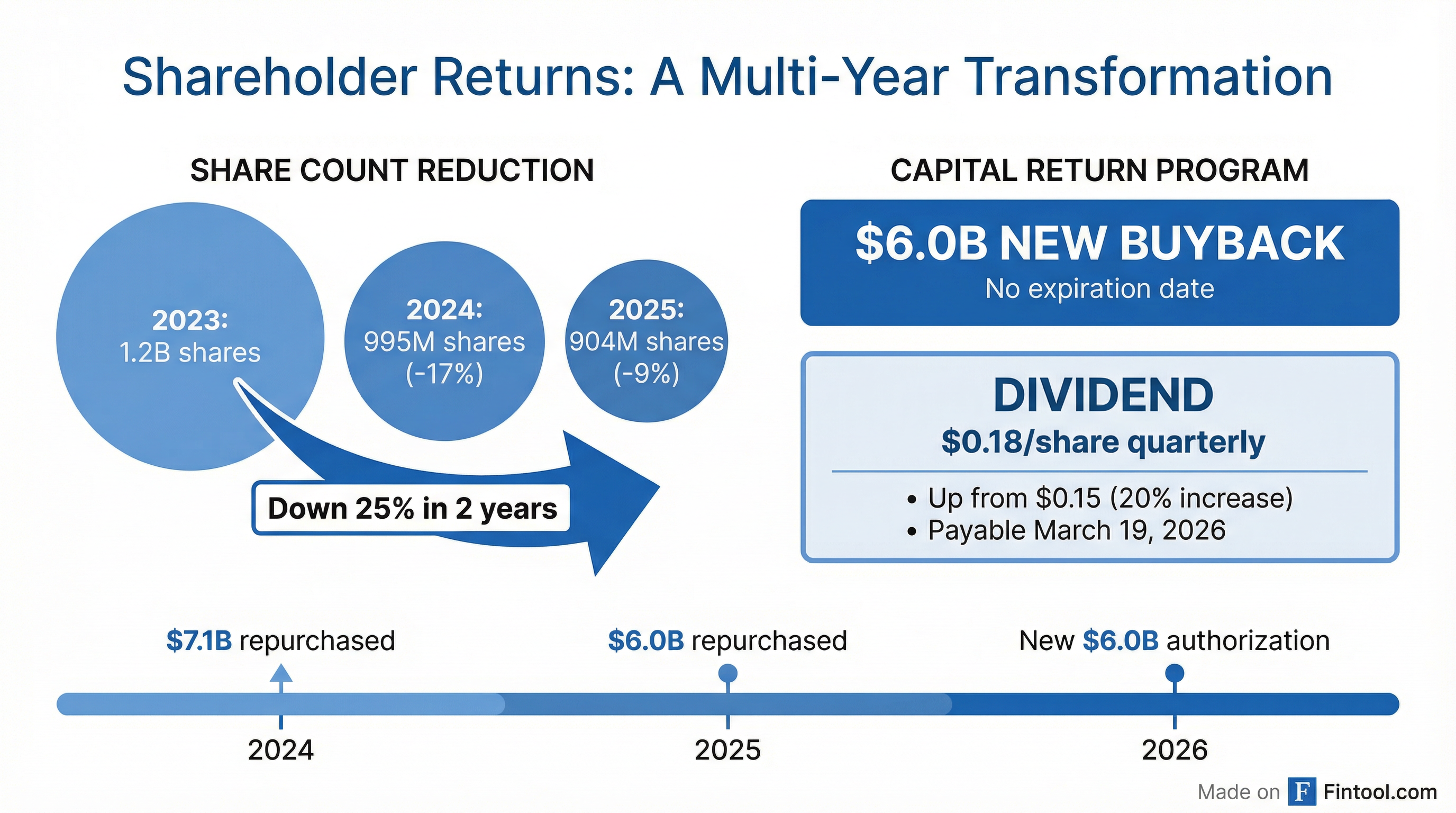

For the full year, adjusted EPS came in at $10.60—flat year-over-year despite significant headwinds—while EBIT-adjusted of $12.7 billion landed at the high end of guidance. GM delivered a total shareholder return of 54% for 2025.

Supply chain note: GM incurred $100 million in incremental costs for alternate chip sourcing related to Nexperia in Q4, with another $100 million of pressure expected in Q1 2026. CFO Jacobson praised the supply chain team for ensuring no production disruptions.

What Did Management Guide?

2026 guidance came in materially above consensus—the real story of this release.

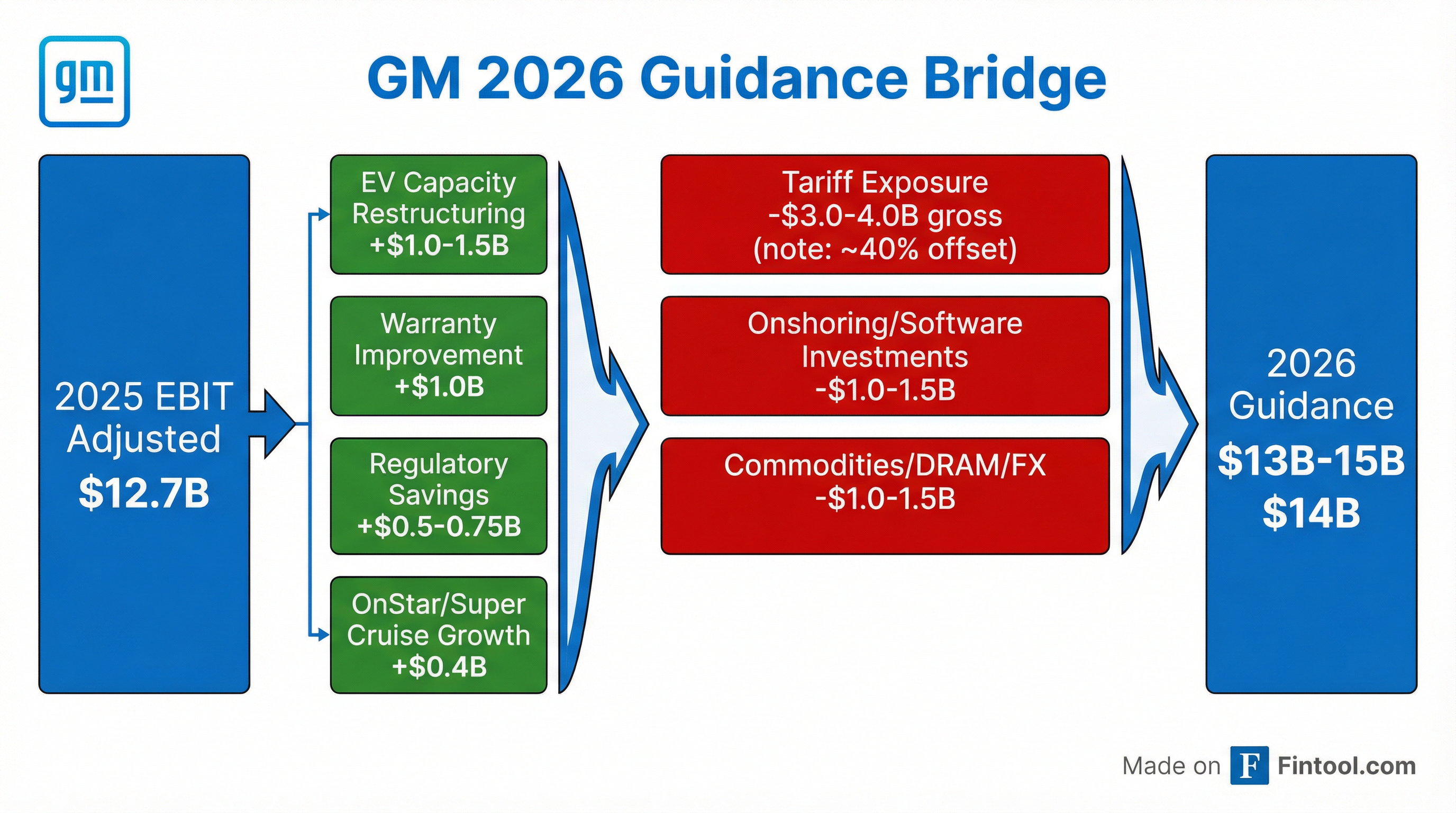

The Street was modeling 2026 EPS of $10.39—GM's midpoint of $12.00 implies 15.5% upside. Management laid out a detailed guidance bridge on the call:

Tailwinds ($3.5B - $4.5B)

Headwinds ($5.0B - $7.0B gross)

Key point: GM offset >40% of gross tariff costs in 2025 through go-to-market actions, footprint changes, and cost reductions. Net tariffs will be lower in 2026 than 2025.

Industry assumption: GM expects total U.S. SAAR in the low 16 million unit range for 2026, with North America ICE wholesale volumes flat to up modestly (constrained by portfolio shifts including Cadillac XT6 end and truck transition downtime).

How Did the Stock React?

Up 8.4% to $86.10—hitting a 52-week high—as investors rewarded guidance and capital returns.

GM opened at $83.63 and rallied throughout the day to close at $86.10, up $6.67. The stock has now appreciated more than 170% since November 2023 when GM announced its accelerated share repurchase program.

Key valuation context:

- P/E on 2026 guidance midpoint: ~7.2x

- Yield at new dividend rate: ~0.8%

- 52-week range: $41.60 - $86.16 (new high today)

- Market cap: $80.3B

What Changed From Last Quarter?

The big shift: EV strategy reset complete, North America margins returning to target.

EV Charge Breakdown

The $7.6 billion in aggregate charges breaks down as follows:

Q3 2025: $1.6B total

- $1.2B non-cash impairments (Orion Assembly transition from EV to ICE)

- $0.4B cash charges (contractual cancellations, supplier settlements)

Q4 2025: $6.0B total

- $1.8B non-cash impairments (BrightDrop discontinuation, other EV assets)

- $4.2B cash charges (contract cancellations, supplier settlements)

Cash impact: $4.6B expected in cash; ~$400M paid in 2025, majority in 2026.

Importantly, GM has not impaired its existing retail EV portfolio—only excess capacity and BrightDrop. Jacobson noted: "We are working to improve the profitability of these vehicles through new battery technologies, engineering improvements, and operational efficiencies, along with a more rational EV market."

Super Cruise and OnStar: The Software Story

Record engagement metrics and accelerating deferred revenue growth.

CFO Paul Jacobson explained the Super Cruise revenue model: "When we sell a vehicle with Super Cruise, we include three years of prepaid services... At the end of three years, customers are approached with 'Would they like to subscribe?' And we've seen attachment rates in the low 40% range with people stepping up and renewing. That's where you're seeing a lot of the growth... coming in at very attractive software-like margins."

Global expansion: Super Cruise will launch in South Korea, the Middle East, and Europe in 2026.

Technology Roadmap: 2028 Is the Big Year

LMR batteries, SDV 2.0, and eyes-off driving all converge in 2028.

Mary Barra on autonomy: "With our Super Cruise experience, the expertise we brought in-house from Cruise, and our learnings from millions of miles of fully autonomous driving, we believe we have everything we need to deliver a safe, reliable, and highly capable system that customers will embrace. Safety is key to building trust in new technologies, as we've demonstrated with Super Cruise. For our eyes-off solution, we are building in redundancy with lidar, radar, and cameras, and we will begin on highways."

GM Financial: Industrial Bank Approval

A quiet but meaningful development: FDIC approval for GM's industrial bank.

GM Financial received conditional approval to launch an industrial bank, enabling it to accept deposits as a new funding source.

CFO Paul Jacobson: "This is really a great achievement and one that candidly probably should have been approved a few years ago... The perseverance of the team to get that through provides yet another opportunity to drive capital in an efficient way for us."

Susan Sheffield, President and CEO of GM Financial, added: "This is going to be complementary to our funding platform... it will allow us to offer depository products and another source of funding to help us bring down the cost of funds somewhat."

The benefit: Lower cost of funds over time, enabling more competitive auto loans. GM Financial delivered EBIT-adjusted of $2.8B in 2025 (within $2.5-$3B guidance) and paid $1.5B in dividends to GM.

Segment Performance: Where Did the Profits Come From?

GM North America drove all the profit; China equity losses narrowed dramatically.

China highlights: New energy vehicles reached nearly 1 million units in 2025, over 50% of total China sales—and profitable across all price points. Barra credited "the right product portfolio and the discipline in which we're managing the business... having a much better relationship with the dealers because we've had a dramatic improvement in their profitability."

Q&A Highlights

On Pricing Assumptions (Dan Levy, Barclays)

Q: How do you get to flat to up pricing given the competitive environment?

A (Jacobson): "We're not modeling any increases. This is really just the annualization of what we did in 2025 coming through primarily for model year 2026... We're cognizant of what the environment is out there, but we're also confident with our vehicles."

On Hybrids (Joe Spak, UBS)

Q: Can you shed light on how the hybrid portfolio is evolving? Will all vehicles use the next-gen SDV architecture?

A (Barra): "Any products that I've talked about are comprehended in the $10 billion-$12 billion dollar capital. SDV, our next-generation software-defined platform, and Super Cruise will be available across both ICE and EV platforms... We're looking at where are the segments that there's the most demand for hybrids. I'll just reiterate that in the last four years, even as others have brought on hybrids, we're still growing share."

On Tariff Mitigation (Andrew Percoco, Morgan Stanley)

Q: What's the offset rate for 2026?

A (Jacobson): "With the go-to-market and then the fixed cost reductions, we'll get an annualization benefit in 2026. So we should end up at a position where our net tariffs are actually lower in 2026 than they were in 2025. So that equates to slightly more than the 40% offset."

On Warranty Progress (Emmanuel Rosner, Wolfe Research)

Q: What drives the $1B warranty benefit?

A (Jacobson): "It really begins with cash. And we've seen that flattening, which is the first thing that needs to happen before you can ultimately come back down the curve on accruals... When you look at the BL87 and the V8 engines, we've seen really good progress with the fixes that the team has put out there with the oil change and some of the testing that we can do at dealerships."

On New Truck Launch Timing (Itay Michaeli, TD Cowen)

Q: What's embedded for the full-size pickup launch?

A (Jacobson): "We'll obviously have to take some downtime as we retool... On the pricing, I would say it's largely going to be a 2027 tailwind... The historical norm of a giant pop in price for a model year really doesn't hold in this environment where pricing has held up on the later years of the model run."

On Inventory Discipline (Michael Ward, Citigroup)

Q: Is inventory discipline adding to cash generation?

A (Jacobson): "The commercial team and the production team have both done a really good job of coordinating the last few years to keep us within that targeted range of 50-60. We had a really strong December month, which is why we ended the year at 48 days of inventory... I think it's that discipline that has really helped us to drive much more consistency in our cash generation."

On Emissions Regulation Savings (Ryan Brinkman, JPMorgan)

Q: Why only $500M-$750M in regulatory savings if you were spending ~$1B on credits?

A (Jacobson): "The credits were roughly split between CAFE and GHG. CAFE, we know we don't need to purchase credits as the administration has already zeroed out the CAFE penalties. GHG is still pending... there's going to be a lag effect as the administration works through the regulatory process. When we purchase credits, we amortize them over the remaining life of those credits."

Key Risks and Concerns

-

EV demand uncertainty: The charges are taken, but the market is unpredictable. Barra noted: "I don't think anyone really knows what the steady-state EV demand will be in this new environment... We saw a fairly substantial pull ahead before the consumer credit went away."

-

Tariff policy volatility: Korea tariff assumed at 15%, but could revert to 25% if legal approvals don't come through. Barra: "We are encouraging and hopeful that the countries will get the regulatory approvals or legal approvals in their country to put into place the deal that was actually negotiated and agreed to in October."

-

China structural pressure: Local competition from subsidized Chinese OEMs continues. Profitable for now, but share has eroded significantly. Even in Brazil, GM faces "stiff competition coming from the Chinese OEMs that are heavily subsidized."

-

Weather disruptions: Jacobson noted: "The weather that we've seen recently has obviously impacted production, likely for everybody... we've got some makeup work to do going forward, but we're confident that the team will be able to do that."

-

Memory chip supply: $1B-$1.5B headwind from DRAM costs; Nexperia issue cost $100M in Q4 with another $100M expected in Q1. Team actively managing.

Forward Catalysts

- Q1 2026 Earnings (late April): First clean quarter post-EV restructuring; track toward 8-10% margins

- March 19, 2026: New $0.18 dividend payable

- New Silverado/Sierra Launch: H2 2026, with some production downtime

- Super Cruise Global Expansion: Korea, Middle East, Europe rollout

- Korea Tariff Resolution: Potential for 15% vs 25% clarity

- Industrial Bank Launch: GM Financial begins accepting deposits

The Bottom Line

GM delivered what matters most to shareholders: an eighth consecutive EPS beat, above-consensus guidance, and accelerated capital returns. The $7.6 billion EV charge clears the decks for what management expects to be a return to 8-10% North America margins in 2026—well ahead of where the Street was modeling.

The guidance bridge is credible: EV losses shrink, warranty improves, regulatory costs disappear, and OnStar/Super Cruise adds nearly half a billion in high-margin software revenue. Headwinds from tariffs and investments are real but manageable, especially with net tariffs actually declining year-over-year.

At 7x the midpoint of 2026 EPS guidance—with 170% stock appreciation since Nov 2023 and shares still 35% below 2023 levels—GM remains one of the most compelling cash return stories in the market. The question isn't whether GM can generate cash. It's whether investors will re-rate the multiple as the EV noise fades and the core business keeps delivering.

CEO Mary Barra: "Getting North America back to the 8%-10% margin is something that we're looking forward to executing through the year and delivering for our shareholders... We've really built a foundation of product excellence, innovation, operating discipline, and resiliency and agility."

View GM Company Profile | Read Q4 2025 Transcript | View Prior Quarter (Q3 2025)